Firms ask Ottawa for more funds despite making more than $35B last year

This article was written by Marco Chown Oved and was published in the Toronto Star on March 10, 2023.

Despite having more than doubled their profits last year, Canadian oilsands companies are spending little on a highly touted carbon-capture project to transform their oil from some of the world’s dirtiest to its cleanest.

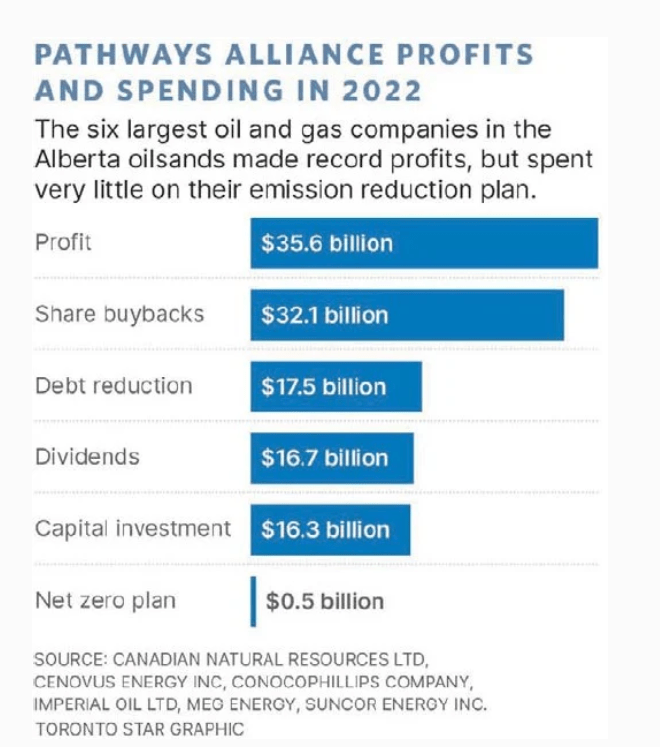

The six companies that form the Pathways Alliance collectively booked a record profit of more than $35 billion in 2022, but spent only $500 million on a plan to capture emissions from the oilsands, pipe them across Alberta and pump them underground by 2030.

Meanwhile, the companies have asked for public funding to cover more than half of their $16.5-billion climate change mitigation project.

“One day, they are telling shareholders they’re making recordbreaking profits — in the words of (U.S. President) Joe Biden, they have more money than God — and then the next day, they go to the government, cap in hand, and say: ‘We need you to pay for us to clean up our operations,’ ” said Keith Stewart, senior energy strategist at

Greenpeace Canada. “The entire cost of this big carbon capture thing that they’re proposing would be half of the profits they made last year.”

Over the past several months, the Pathways Alliance has gone on a public relations offensive, taking out full-page ads in newspapers and 30-second spots on podcasts to promote the carbon capture and storage plan, saying it will help Canada achieve climate change goals by reducing emissions in the oilsands to net zero by 2050.

“There will likely never again be a period where this type of profit is generated in the oil industry,” said David Macdonald, a senior economist with the Canadian Centre for Policy Alternatives. “The stars have aligned for the oil gas companies to make those investments if they wanted to — but it’s not happening.”

A look at the financial reports of Canadian Natural Resources Ltd., Cenovus Energy Inc., ConocoPhillips Co., Imperial Oil Ltd., MEG Energy and Suncor Energy Inc., shows the companies spent far more on priorities other than climate change.

Collectively, they shelled out $32.1 billion on share buybacks, which boost the stock price, and $16.7 billion on dividends — direct cash payments to shareholders. They also spent $17.5 billion reducing their debt and another $16.3 billion on capital investment in their oil and gas production.

But when it came to their plan to reduce emissions, their spending was only half a billion dollars — 1.4 per cent of their profits.

There’s a disconnect between what oilsands companies are saying and what they’re doing with “this tremendous amount of money,” Macdonald said.

“They don’t need more tax breaks. They don’t need anything from government, frankly, at all. They have all the money that they could ever wish for on hand right now to make these key investments. And they’re not making them.”

In response to questions, Pathways Alliance spokesperson Jerrica Goodwin said “our companies are spending significantly on our 2030 goal.”

Citing a recent $10-million engineering contract and other feasibility studies and Indigenous engagement efforts, Goodwin said the Alliance members plan to invest a total of $24.1 billion in the next seven years “with co-funding support from Canadian governments.”

The centrepiece project would install carbon capture technology at a dozen sites in the Alberta oilsands and connect them via a 400-kilometre pipeline to a “storage hub” near Cold Lake, where the captured carbon would be injected into geological formations underground. Slated to be completed by 2030, the plan estimates it would reduce oilsands emissions by 10-12 megatonnes, or about 10 per cent of total emissions from the sector.

However, those are only the emissions caused by extracting and refining the oil and don’t include the emissions caused by burning the fuel in cars, furnaces and industry, estimated to be two to three times greater.

Goodwin says the carbon capture project cannot be started until all the permits are complete.

“Projects of this size require significant upfront work and a strong partnership between industry and governments to proceed,” she added. “It is impossible to invest in the construction of these projects, because they have not been approved by governments.”

Most of the spending on the project will come later, during the construction phase, she said.

After Russia invaded Ukraine in February 2022, global oil prices spiked, almost doubling by early April. This led to windfall profits for oil companies around the world, even in places such as Alberta, which were unaffected by the conflict.

Imperial Oil CEO Brad Corson said the war has created circumstances that have been good for business.

Singling out “high commodity prices” driven by “ongoing geopolitical events,” Corson told investors on an earnings call last October that “the overall macro environment remains quite positive for our financial performance.”

Profits at the six Pathways Alliance oil companies more than doubled in 2022, led by Cenovus, which increased its bottom line by 999 per cent. Canadian Natural Resources was the laggard, with only a 43 per cent bump in profits over the previous year. ConocoPhillips’ oilsands profits increased 62 per cent. All the others either doubled or tripled their profit.

“This is a publicly owned resource that they are pulling out of the ground and they’re now making windfall profits,” Greenpeace’s Stewart said. “They aren’t reducing greenhouse gas emissions. They aren’t cleaning up their abandoned wells. And now we’re hearing that for the last nine months, Imperial Oil’s tailings pond has been leaking toxins into the drinking water of a First Nations (community) without telling them.

“When you look at these eye-watering profits, we should be saying: ‘How can we redirect those resources to helping people deal with inflation, which is being driven in large part by those profits, and investing in a clean energy transition?’ ”

Greenpeace is calling for an excess-profits tax on the oil and gas industry, much like the one imposed on the financial industry after its pandemic-related windfall gains.

Federal Environment Minister Steven Guilbeault has threatened to “force” the oil industry to reduce its emissions if they don’t start doing so themselves. Later this year, Ottawa will enact a hard cap on oil and gas emissions, he said.

The Pathways Alliance has said it will need additional public subsidies and tax credits to fund its carbon capture plan.

After the federal government unveiled $8.6 billion in carbon capture tax credits last year, Cenovus CEO Alex Pourbaix said industry will need “more help.”

Calls for additional subsidies increased after the United States passed the Inflation Reduction Act, which provides large tax credits for a variety of emission reduction and green energy projects.

“We continue to work with the federal and Alberta governments to ensure Canada’s co-funding programs and regulatory environment for (carbon capture and storage) are globally competitive and that emissions reduction targets for our industry are realistic and achievable,” said the Pathways Alliance’s Goodwin.

Meanwhile, emissions from the oilsands have been growing. According to the government’s national carbon inventory, emissions have more than doubled since 2005.

Crude from the Alberta oilsands is among the dirtiest oil in the world. While the industry contests the claim that Canadian oil has the biggest carbon footprint, several academic studies have shown that the process of mining and separating oil from sand in Alberta produces twice as much carbon per barrel than the average in North America.

While the oil and gas industry has made significant gains in curtailing methane leaks, cutting them by 28 per cent since 2015, emissions from oil and gas extraction have risen by about half that amount over the same period of time.

“This is an industry that in the long term, we need to wind down. It’s not going to end tomorrow. It’s not going to end this year. It’s not going to be in 10 years. But in 50 years it will need to end,” Macdonald said. “We’ve got this opportunity, this flood of corporate cash to make these changes and yet it’s not being spent on massive transitions away from fossil fuel towards other means of energy generation.”

‘‘ The entire cost of this big carbon capture thing that they’re proposing would be half of the profits they made last year.

KEITH STEWART SENIOR ENERGY STRATEGIST AT GREENPEACE CANADA