Bank beats out JPMorgan Chase in U.S. to lead the world despite zero-emission commitment

This article was written by Kevin Orland and was published in the Toronto Star on April 14, 2023.

Royal Bank of Canada topped JPMorgan Chase & Co. last year to become the world’s largest backer of fossil-fuel companies, providing more fodder to critics who say the lender isn’t living up to its climate commitments.

Royal Bank provided $42.1 billion (U.S.) of funding to the industry, up 4.2 per cent from a year earlier, surpassing the $39.2 billion provided by JPMorgan, according to the Rainforest Action Network’s 14thannual “Banking on Climate Chaos” report. The figures include lending as well as debt and equity underwriting.

While Canada’s largest lender by assets has committed to zeroing out the emissions associated with its financing activities, environmentalists have increasingly targeted its involvement with fossilfuel companies. The Torontobased lender has especially come under fire for working with Canada’s oilsands firms, which produce one of the world’s most carbon-intensive grades of crude.

“RBC is really a critical financier for tarsands, which is problematic both from an environmental and a human rights perspective,” April

Merleaux, research manager for Rainforest Action Network, said in an interview.

JPMorgan had led the rankings since 2019, but its financing to the industry fell 42 per cent last year. Citigroup Inc. and Wells Fargo & Co. posted similarly large declines. Many U.S. oil producers used last year’s record profits to pay down debt, while others turned to private markets for financing. Investmentbanking activity also slumped due to broader market turmoil.

“We provide financing across the energy sector: supporting energy security, helping clients accelerate their low-carbon transition and increasing clean energy financing with a target of $1 trillion for green initiatives by 2030,” said Charlotte Powell, a spokesperson for New York-based JPMorgan, in an emailed statement.

Wells Fargo, Bank of America Corp. and Citigroup round out the top five, with U.S. banks accounting for a combined 28 per cent of all fossil-fuel financing last year, according to RAN’s report. Mitsubishi UFJ Financial Group Inc. led in Asia, while BNP Paribas SA was tops in Europe.

RBC said the report’s authors don’t validate their findings with the bank, so it can’t confirm their conclusions. The bank also said the report doesn’t measure its progress in meeting climate goals and that it’s confident with its strategy.

“We are actively working with our clients, governments and many stakeholders toward a net zero economy,” spokesperson Andrew Block said in an emailed statement. “This includes financing for renewable-energy projects and providing capital to clients in higher-emitting sectors to support their transition journeys as there aren’t enough renewables available today to power our world.”

Royal Bank set a goal last year of lowering the intensity of emissions that its oil and gas clients generate from operations — known as Scope 1 and 2 — by 35 per cent by 2030, relative to 2019 levels. It’s also planning to reduce the intensity of emissions from the burning of the fuels those companies sell — Scope 3 emissions — by 11 per cent to 27 per cent in that time frame.

Using emissions intensity — instead of absolute emissions — allows Royal Bank to increase lending to high-emitting sectors and lets its clients emit more carbon through rising production as long as their operations are growing more efficient.

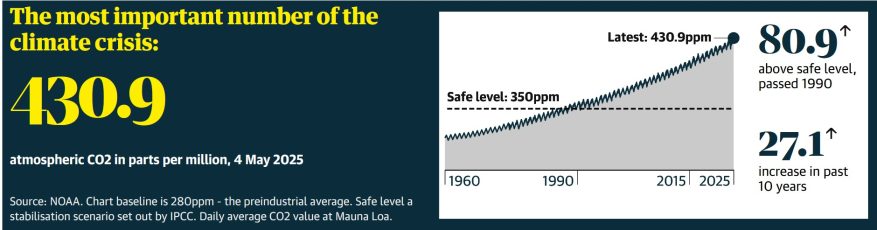

Strong interim targets for absolute emissions are important because the scientific consensus is that global carbon dioxide emissions need to fall by about 45 per cent from 2010 levels by 2030 to limit global warming to 1.5 C, according to the Intergovernmental Panel on Climate Change.

“Those intensity targets really seem like they’re creating a kind of loophole,” Merleaux said. “We need to see the scope three absolute emissions reductions and we need to see them on a really ambitious timeline.”

Royal Bank is among the 49 of 60 banks ranked in the report that have made net zero commitments. Still, the lenders funneled a combined $150 billion last year to the 100 largest fossil-fuel companies.

Marchers protest during the Royal Bank of Canada’s annual general meeting at the Delta Bessborough hotel in Saskatoon, Sask., on April 5. Royal Bank provided $42.1 billion (U.S.) of funding to the fossil-fuel industry last year.