This article was written by Alex Ballingall and was published in the Toronto Star on July 18, 2023.

They’re big, profitable corporations whose products — while essential to modern life — created the climate crisis.

The government also supports them with your tax dollars.

It’s a long-standing feature of Canadian policy that is about to change, as the federal government prepares to finally make good on its promise to eliminate at least some of the fossil fuel subsidies it gives to oil and gas companies in this country. Federal Environment Minister Steven Guilbeault’s office would not confirm when it will release long-anticipated details of which domestic fossil fuel supports it will cut by the end of 2023. A spokesperson would only say Monday that a framework to define which subsidies to scrap is coming “very soon.”

It’s a potentially significant step for climate action in Canada that environmentalists are watching closely — one that comes after Guilbeault pledged last week to lobby other countries to phase out “unabated” fossil fuels at this year’s annual climate summit in the United Arab Emirates.

It’s also being met with skepticism, since Canada is still promising billions of dollars in tax credits to help the oil and gas sector reduce its greenhouse gas emissions, which many climate advocates consider unnecessary and expensive new subsidies. The government also bought and financed construction of the Trans Mountain expansion project, a major oil pipeline to the west coast that is now expected to cost $30.9 billion.

Here’s everything you need to know about the coming framework to cut federal fossil fuel subsidies.

It’s been a long time coming

The move is the culmination of a pledge made way back in 2009. That year, Canada and its peers in the G20 agreed to “rationalize and phase out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption.”

Under Justin Trudeau’s Liberals, Canada promised to do this by 2025, then moved that deadline up to the end of 2023 when they won the last federal election.

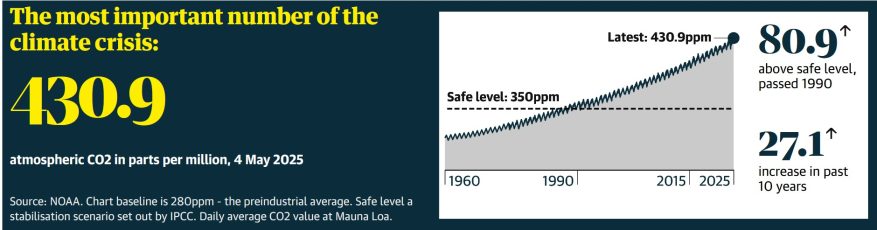

With record wildfires blazing across the country and scientists warning time is running out to prevent the worst extremes of the warming world, the removal of public supports for the fossil fuel sector is seen by environmentalists as an essential feature of the fight against climate change.

António Guterres, the secretary general of the United Nations, has called it “moral and economic madness” to put more money toward fossil fuel projects.

“This isn’t a problem we don’t understand. We have to phase out the production and use of oil and gas,” said Julia Levin, a climate policy expert with the advocacy group, Environmental Defence.

“Continuing to subsidize the cause of the climate crisis diverts money — public money — away from what we need to be building, and it locks in more dependence on what we need to be phasing out.”

For Kathryn Harrison, a political scientist who specializes in climate policy at the University of British Columbia, subsidies undermine the purpose of policies like the carbon price, which are designed to make it more expensive to burn fossil fuels that cause climate change. That’s the case even for public dollars meant to encourage companies to invest in technology to capture and store their emissions, or to clean up abandoned drilling wells, she said.

“If we give them money to make it cheaper to reduce their pollution, they’ve got more money to do other things, like explore more or charge less for their product and sell more of it,” Harrison said.

How much money do companies get?

Estimates vary, depending on the definition of a subsidy.

The Canadian Association of Petroleum Producers, a lobby group representing oil and gas companies, denies it receives any “production subsidies,” arguing that tax breaks aren’t subsidies because they represent forgone revenue, rather than direct transfers of money from public coffers.

The association is declining to comment until Guilbeault releases the framework to define which subsidies to eliminate before the end of the year.

Pro-green groups, however, have used wider definitions to conclude public support is substantial.

Levin’s organization says the federal government provided $3.5 billion in “direct subsidy programs” to oil and gas companies in 2020, with another $13.5 billion in financing through Crown corporations like Export Development Canada. This included money through government programs mean to help the sector cut its greenhouse gas emissions and clean up abandoned drilling wells.

Earlier this year, the Parliamentary Budget Officer calculated that tax deductions for the oil, gas and coal sectors reduced federal revenues by around $1.8 billion per year between 2015 and 2019.

So what will Canada eliminate?

This is the big question that Guilbeault’s framework will finally answer. Already, in the 14 years since the G20 commitment, Canada has eliminated tax breaks for the sector, like the accelerated capital cost allowance for oilsands operations.

But for the official definition of what supports Canada will cut by the end of this year, Guilbeault hinted last week that reporters should look at the parameters the government used when eliminating public supports for fossil fuel projects abroad.

Released last December, those guidelines spelled out how Canada would stop funding “new,” “direct” and “unabated” fossil fuel projects in other countries.

Translation: no new support from the government or Crown corporations for fossil fuel projects abroad that don’t use technology to significantly reduce their emissions.

What does that mean for domestic subsidies?

That’s not a prescription for the total elimination of public supports to the sector, but Levin did say it was “quite strong.”

There is no indication, for instance, that the government will scrap public funding to help oil and gas companies reduce their emissions and adopt emerging technology to capture and store their greenhouse gas output.

A tax credit for carbon capture, utilization and storage technology was a major plank in last year’s federal budget, and the government points to programs it has established under the Liberals to help the sector reduce its emissions from producing oil and gas as key planks of its climate agenda.

It’s also not clear if the framework will include details of the promised plan to stop financing the sector through Crown corporations like Export Development Canada, which is providing money and loan guarantees for the Trans Mountain expansion project.

A spokesperson for Guilbeault declined to say Monday whether the framework to eliminate subsidies will come with the promised plan to stop all public financing.

For Levin, the framework could also set an important bar for the international community. Canada, she said, is the first country to roll out an official definition of which subsidies it will eliminate under the G20 pledge.

“If done well, this is a road map for other countries to use,” she said. “If done poorly, it sets a really dangerous framework that will allow other countries to shirk their responsibilities as well.

“So all eyes will be on Canada this week.”