This article was written by Peer Zumbansen and Daniel Tsai, and was published in the Toronto Star on August 26, 2023.

As governments fiddle while the Earth burns, environmental, social and governance (ESG) factors call on corporations to immediately address climate change and to establish sustainability and ethical business practices. However, for corporations, these are often voluntary commitments and not legal requirements.

The Canadian federal and provincial governments have sorely lacked the leadership and the ideas to implement ESG in a way that would have a transformative impact on climate change and society. Despite pledging $200 billion to fight climate change, Canada has failed to spend anywhere near that, as the Star has reported.

Consequently, ESG faces the stubborn resistance of corporations as they seek to maximize profits while virtue signalling to the public with greenwashing measures.

At McGill University’s CIBC Office of Sustainable Finance, we propose a series of transformative reforms for governments and corporations to incentivize ESG and engage in climate change initiatives. The reforms will bring about increased Canadian competitiveness, innovation, economic prosperity and a secure future.

First, the Canadian Income Tax Act should include tax credits and deductions to support ESG and purpose-driven corporations (for example, those developing climate change technologies). Our existing tax system currently provides credits for mining and oil and gas sectors, plus favourable tax treatment for investors in such sectors by accessing special flow-through shares to deduct corporate losses against their personal income. Similarly, this could be applied to purposedriven investments.

Canada should also develop a special tax status targeted at organizations that meet ESG-related standards throughout their business practices, but that would provide tax incentives and bend the development curve to technologies and business models that address climate change.

This special status should introduce a sliding-scale corporate tax break aimed at small and medium enterprises (SMEs) as well as tax

incentives to support corporations implementing ESG-conscious business practices.

Research suggests such tax and climate incentives will help spur economic growth, investment and development in beneficial industries and technologies, the way they have with electric vehicle development among car manufacturers.

In addition to the Clean Technology Investment Tax Credit in 2023’s federal budget, the Canadian government can further leverage taxation schemes to encourage businesses to invest in a purpose-based economy. The Brookings Institution argues that tax incentives “can power more equitable, inclusive growth.” Targeted corporate tax breaks can motivate corporations to better integrate sustainable practices within their business models.

Second, corporations should be legally required to include a social-purpose statement in their bylaws and implement mechanisms to increase stakeholder transparency and engagement by creating and publishing industry-specific universal ESG metrics. Amending the tax system to develop a special status to reward organizations that meet an ESG-related standard throughout their business practices would create targeted investment vehicles that favour and proliferate socially responsible investment.

Third, the Canadian federal government and its banking regulator can set rules requiring banks to implement sustainability into their underwriting policies. For example, assigning a higher-interest cost for loans that result in poor ESG outcomes

will transform industries to invest in good ESG.

Government can help guide the Canadian financial sector to become a sustainable system. This means protecting large institutional investors making bold (but prudent) decisions to green their portfolios, while providing incentives to guide investment in green technologies and products.

Fourth, the creation of universal government standards (similar to the Organisation for Economic Cooperation and Development) for ESG and a public sustainability index for lending and investment would act as a guide for banks and public corporations and encourage accountability and transparency and end greenwashing.

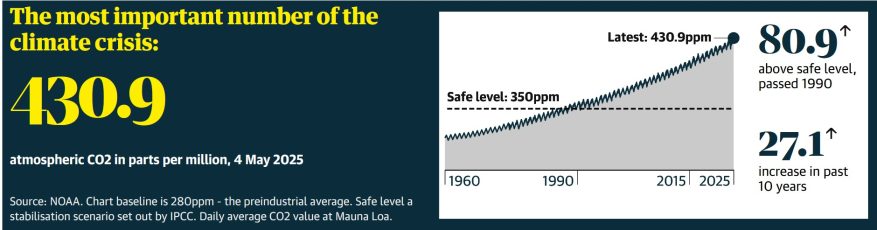

Climate change is everything. It is inextricably linked to modern economic, financial and governance systems, and shatters the pretence that unlimited economic growth is always possible.

With unprecedented wildfires in Canada, and the Earth suffering its hottest July in 120,000 years, governments and corporations have the power and means to stop climate change.

New approaches to government regulation and ESG for corporations must be adopted now and go beyond empty promises. PEER ZUMBANSEN IS PROFESSOR OF BUSINESS LAW AND THE CHAIR OF THE CIBC OFFICE OF SUSTAINABLE FINANCE AT MCGILL UNIVERSITY. DANIEL TSAI IS SENIOR FELLOW IN THE CIBC OFFICE OF SUSTAINABLE FINANCE, LECTURER AT U OF T AND TMU, AND FORMER SENIOR POLICY ADVISER IN THE CANADIAN GOVERNMENT.