This article was written by Toby Heaps and was published in the Toronto Star on June 29, 2024.

TOBY HEAPS IS THE CO-FOUNDER AND CEO OF CORPORATE KNIGHTS, A MEDIA AND RESEARCH COMPANY BASED IN TORONTO FOCUSED ON ADVANCING A SUSTAINABLE ECONOMY.

There’s no question that many major Canadian companies are applying vision and innovation, and making impressive progress toward circular business models, decarbonization and greater social equity.

That’s the encouraging takeaway from Corporate Knights’s comprehensive annual assessment of corporate citizenship on the part of all Canadian companies with $1 billion or more in annual revenues.

But having done this analysis for nearly 25 years, I increasingly focus not just on the achievements of the top ranked Best 50 companies, but also on what our analysis reveals about the comparative scope and pace of progress economywide. That’s the sobering part of the exercise.

But let’s start on the positive side of the ledger.

Looking at the 2024 50 Best Corporate Citizens ranking, I’m encouraged first by diversity. Three distinct sectors and business models are represented at the top of the ranking via first-place Société de transport de Montréal, followed by Stantec Inc. and the Co-operators in second and third spots. Good corporate citizenship is clearly not a niche phenomenon.

More fundamentally, I’m encouraged by the growth in investments and revenues that align with credible definitions of sustainability. We weigh these metrics heavily in our ranking given their outsized importance as drivers of economic transformation and long-term corporate success.

Within the full universe of Canadian companies assessed, total sustainable investments stood at $41.3 billion in 2022 and sustainable revenues at $155.1 billion. That’s up an impressive 82 per cent and 77 per cent respectively from 2019. In contrast, growth in nonsustainable investment was only four per cent in that same sample and time frame, and growth in nonsustainable revenues only 20 per cent.

So money is flowing in the right directions, and driving improvement on key metrics such as carbon.

Average carbon productivity among large Canadian companies — that is, the revenues earned per tonne of carbon emitted — jumped from $700,000 to $1 million between 2019 and 2022 (and averages $1.6 million among the Best 50 companies). Underlying that is an eight per cent reduction in absolute carbon emissions on the part of all companies assessed.

This year’s ranking even provides some reason for optimism on key and often troubling social performance metrics. True, increases in CEO pay continue to far outstrip increases in average worker pay. But cash taxes paid are now trending up faster than corporate profits, and current trends suggest that both gender and racial parity on boards are in sight in the next decade.

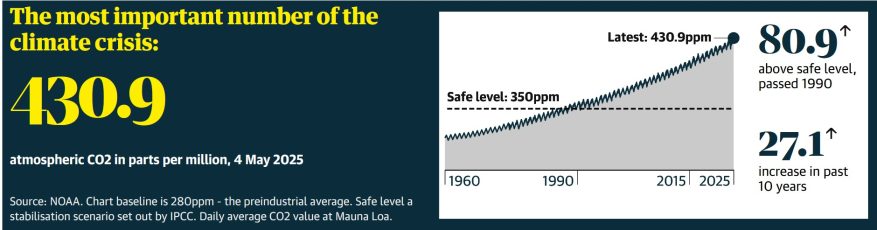

So that’s all to the good. But with threats such as blowing past the 1.5-degree temperature-increase threshold bearing down on us, it’s not good enough to only ask: Are we making progress? We also need to know if we’re progressing fast enough — and in many respects we are clearly not.

The $41.3 billion in sustainable private-sector investment is a lot, but combined analysis from our federal government and from the Glasgow Financial Alliance for Net Zero indicates that as of this year, we need to be hitting a level of $98 billion and sustaining it through the decade.

Similarly, an eight per cent reduction in absolute carbon emissions over four years is probably most accurately thought of as a good start, given that the UN Environment Programme has indicated we need to hit about that same level of reduction — 7.6 per cent — on an annual basis through the decade.

So does the bad news eclipse the good? Not entirely, but my net takeaway is that we must insist on a broader scope and faster pace of delivery on the promise of good corporate citizenship. Fortunately, we have means available of doing just that.

Clean Economy Investment Tax Credits (ITC), for example, have been proven in the U.S. and elsewhere to be able to generate large-scale private investment in sustainable activities and revenue opportunities. They can be game-changers in Canada too, but we’re taking too long to implement them, with only two of six promised ITCs passed with detailed guidance by the Canada Revenue Agency.

Our analysis further suggests that even many of those companies who are stepping up would benefit from working within better defined frameworks — ones designed to help maximize the impact of every dollar directed toward a sustainable use. Even among this year’s Best 50 companies for example, only half have formal net-zero plans meeting criteria set by the Science-Based Targets Initiative or something similar (a figure that drops to 14 per cent among the full universe of companies).

If you don’t know where you’re going, any road will get you there, but we don’t have the luxury of meandering. We know where our decarbonization and other essential journeys need to lead to, and we know we need to get there quickly.

So it’s urgent that we pick up the pace and get on track, and ensure that today’s leading corporate actions become tomorrow’s norm.

We must insist on a broader scope and faster pace of delivery on the promise of good corporate citizenship